1.2.1 Global oilseed production

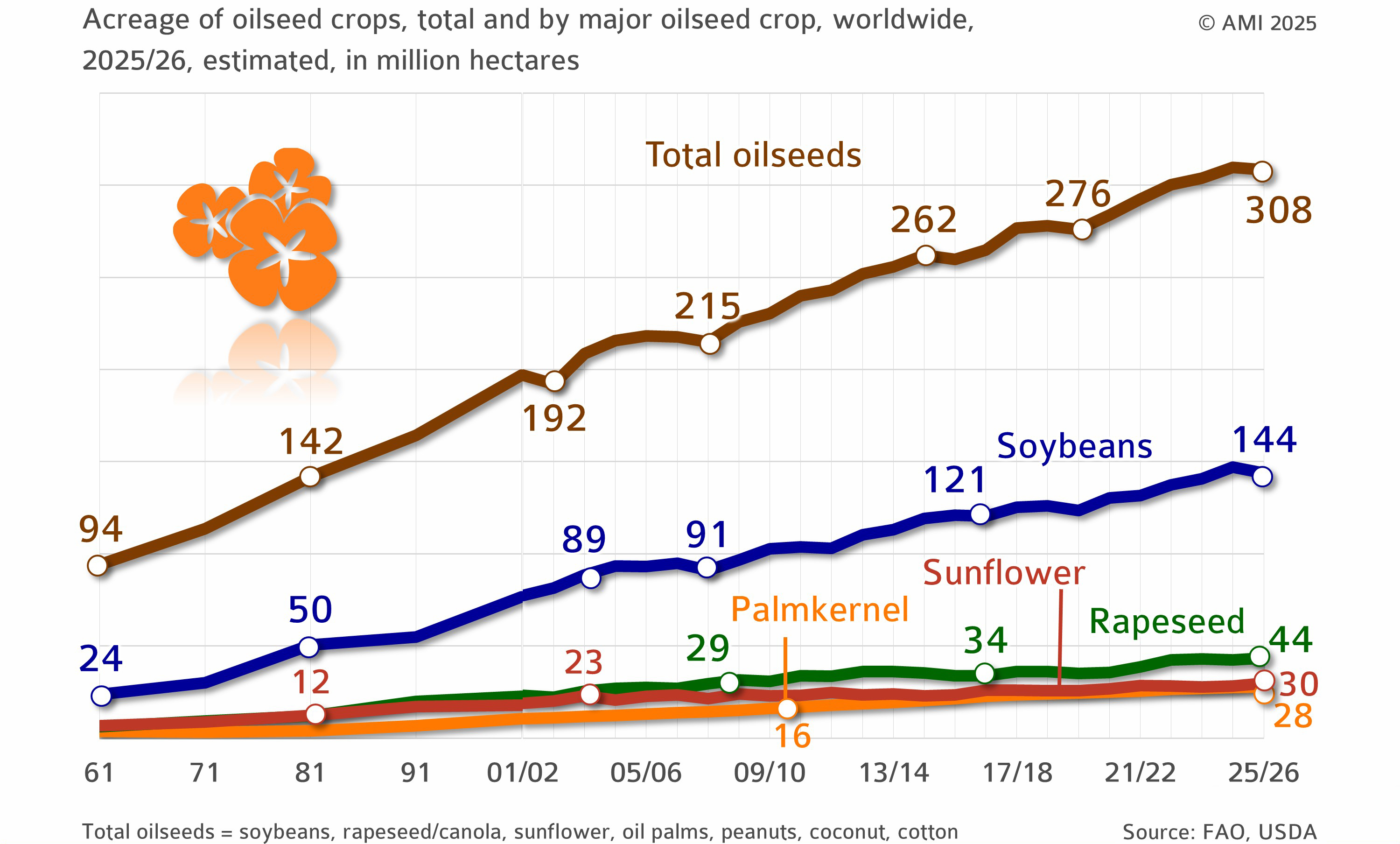

World oilseed production will presumably reach 308 million hectares in the 2025/26 crop year, slightly less than in the previous year (–0.4 per cent). The decline is mainly due to lower momentum in soybean production. Weaker margins, higher production risks and more stringent sustainability standards are curbing the expansion in soybean farming, especially in South America. The soybean area is set to decrease to 144 million hectares in 2025/26.

Rapeseed cultivation will remain stable in many regions, rising modestly to 44 million hectares. Sunflower cultivation remains virtually unchanged at 28 million hectares. Oil palm cultivation is expected to fall to 30 million hectares in the 2025/26 crop year.

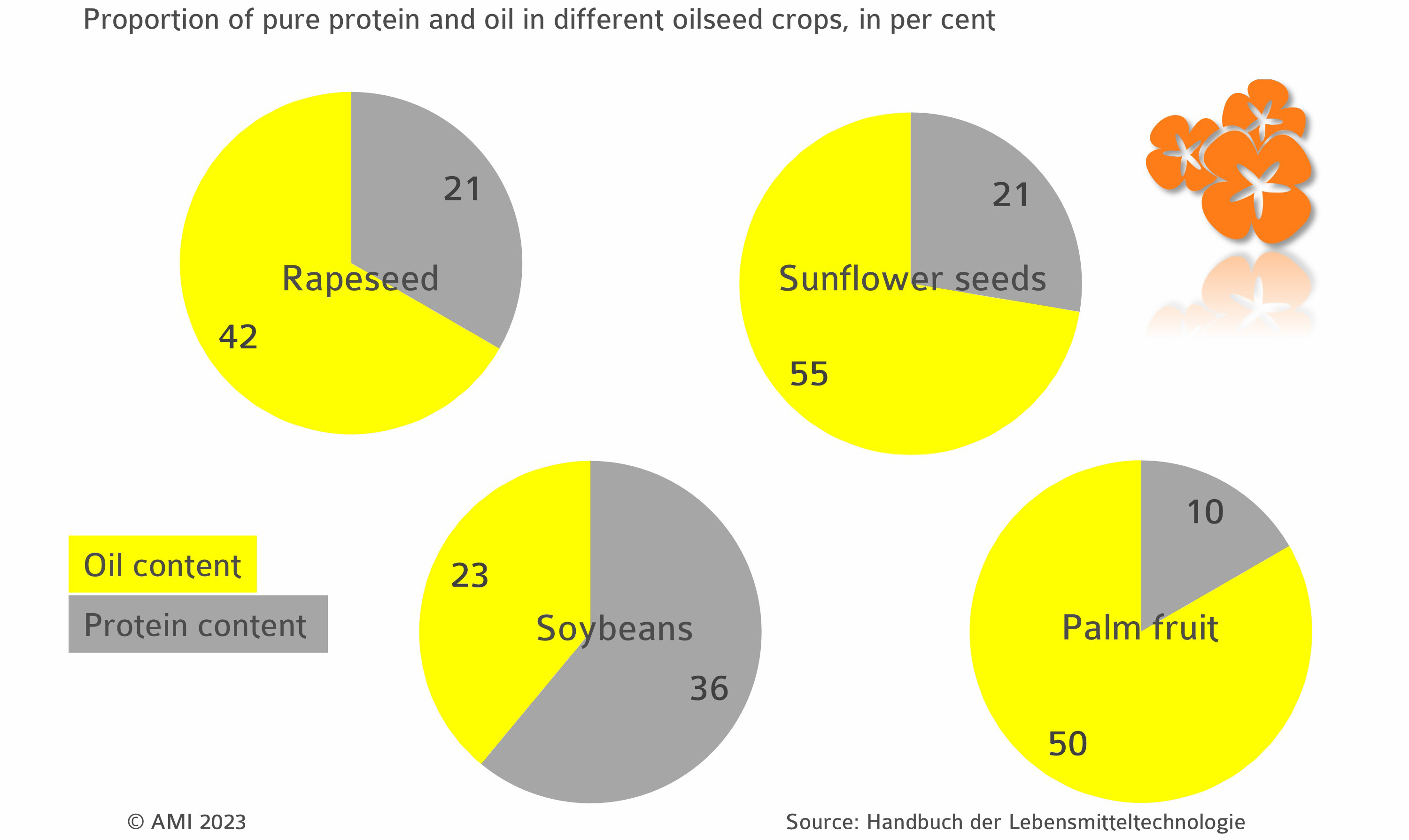

All in all, soybean remains the leading protein and oil crop globally. Owing to the high protein content of soybeans, production is especially predominant in North and South America. Rapeseed breeders are working on improving the crop's protein quality in order to upvalue rapeseed meal as a substitute for soybean meal in animal feeds and, in the future, more in the human diet.

Slight decline in acreage for oilseeds

1.2.1.1 Composition of oilseed crops

Sunflowers have the highest oil content

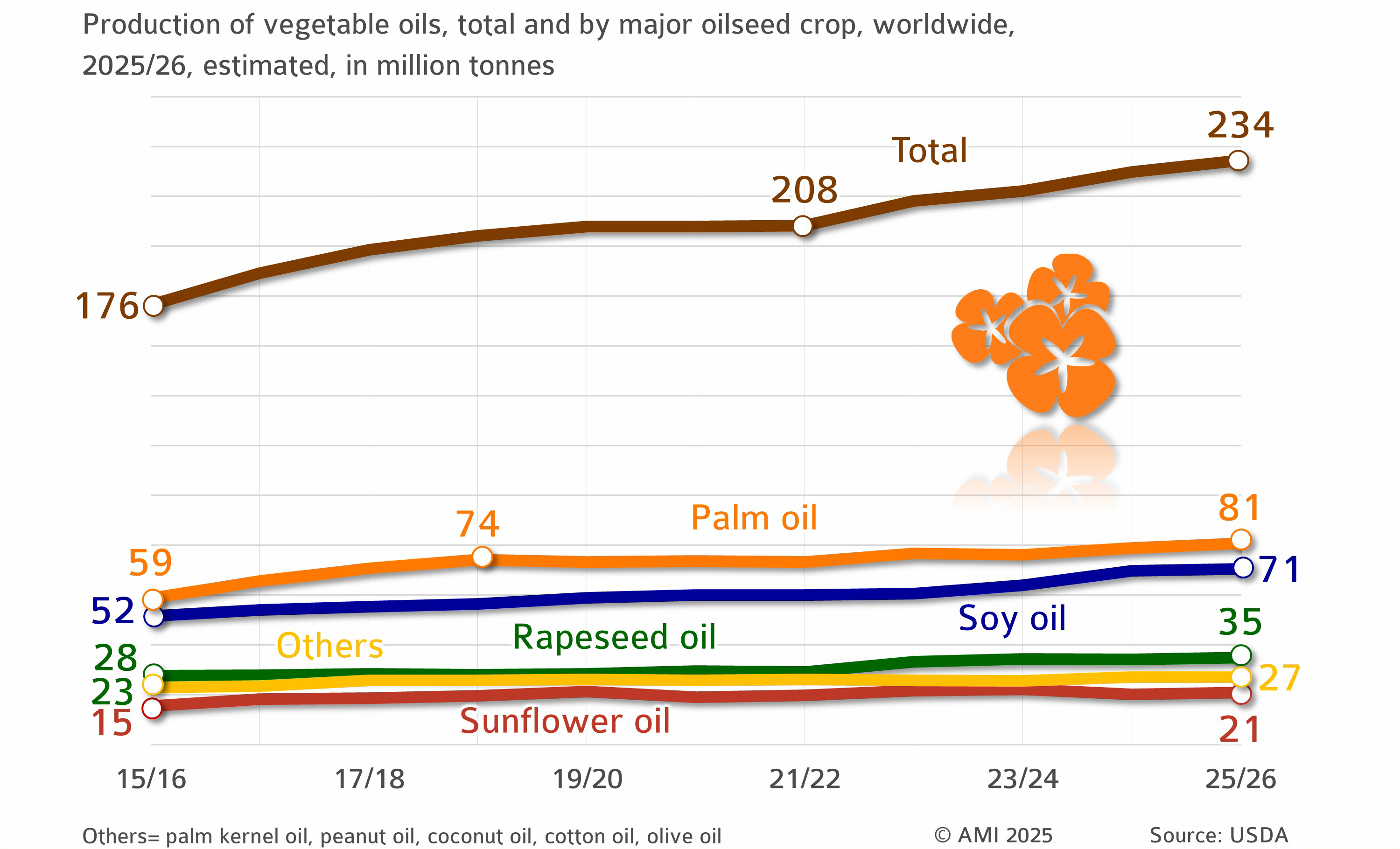

1.2.2 Global vegetable oil production

Global production of vegetable oils is likely to hit a new record in 2025/26. According to estimates by the US Department of Agriculture (USDA), production is expected to increase to 234.4 million tonnes, marking a roughly 2 per cent rise on the previous year. This means that demand of an estimated 228.8 million tonnes can be fully met. Palm oil and soybean oil together account for roughly 65 per cent of global vegetable oil production. Rapeseed oil follows at 15 per cent and sunflower seed oil at just under 9 per cent.

Palm oil remains the world's most important vegetable oil. For the 2025/26 crop year, production is expected to reach approximately 80.8 million tonnes, representing an increase of 1.9 million tonnes year-to-year. Indonesia (47.5 million tonnes) and Malaysia (19.5 million tonnes) are the largest palm oil-producing countries, followed by Thailand (3.4 million tonnes). Production of soybean oil is expected to grow 1 per cent, reaching 70.6 million tonnes. At 20.5 million tonnes, China is set to remain the world's largest producer of soybean oil, followed by the US at 13.7 million tonnes. Production of sunflower seed oil will presumably reach 21 million tonnes in 2025/26, a rise of roughly 4.5 per cent. Rapeseed oil output is expected to increase to 35 million tonnes.

Palm oil dominates the vegetable oil market

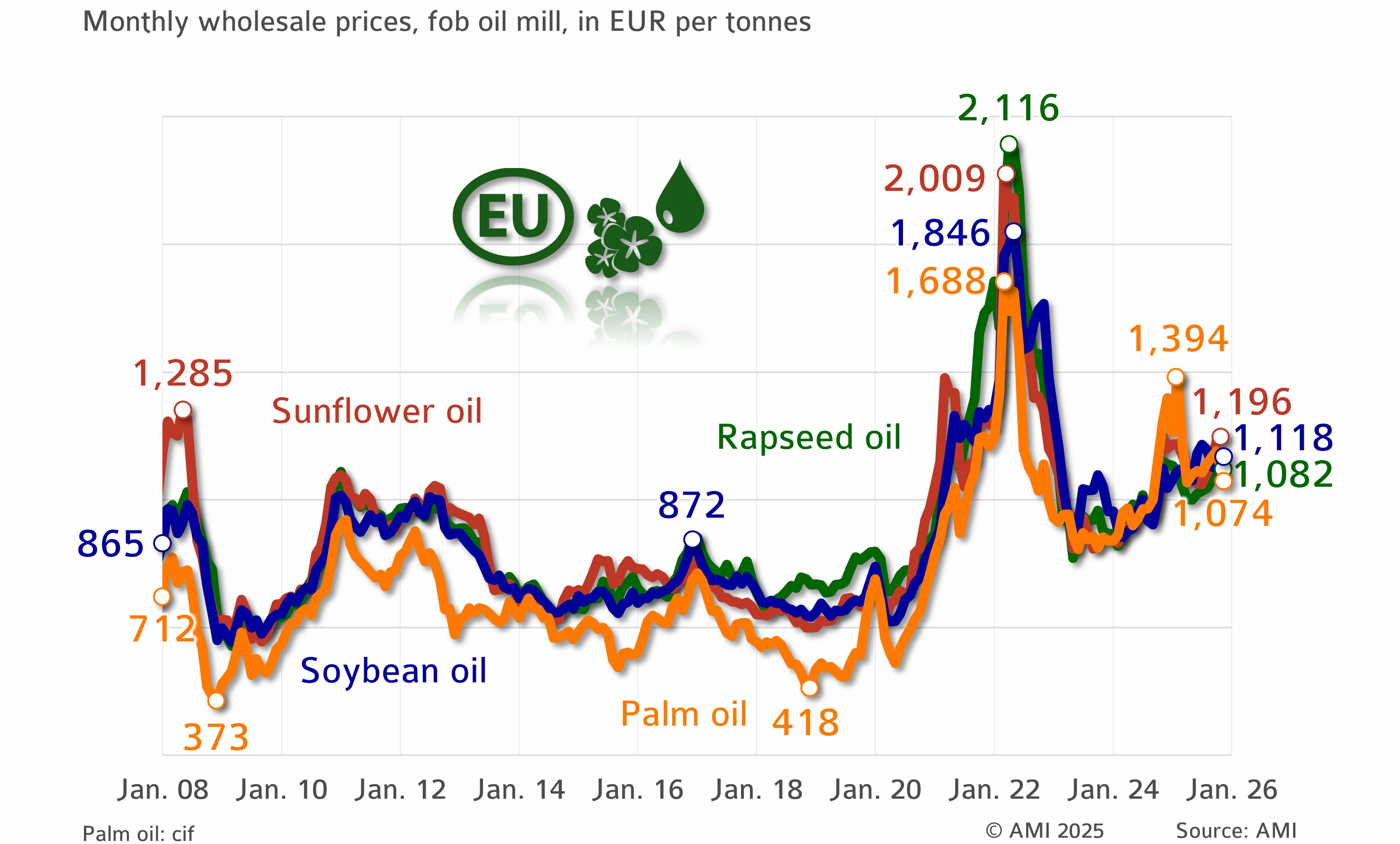

1.2.2.1 Changes in vegetable oil prices

The situation on the vegetable oil market, which has been tense since 2021, was further exacerbated in 2022 by the war in Ukraine. Export uncertainty in the Black Sea region triggered a sharp jump in prices, after which prices soon returned to normal again. Wholesale prices in the EU rose again in 2025 to a level consistently above EUR 1,000 per tonne.

Above all, sunflower seed oil was driven by the scarcity of supply from the Black Sea region. Higher prices temporarily dampened demand, with some importers switching to lower-priced alternatives. Soybean oil followed the firming trend in feedstock prices, supported by international trade and demand signals. Rapeseed oil also rose in the wake of the overall market development, although demand remained generally limited across the EU.

Prices for vegetable oils rise

1.2.3 Global oilseed supply

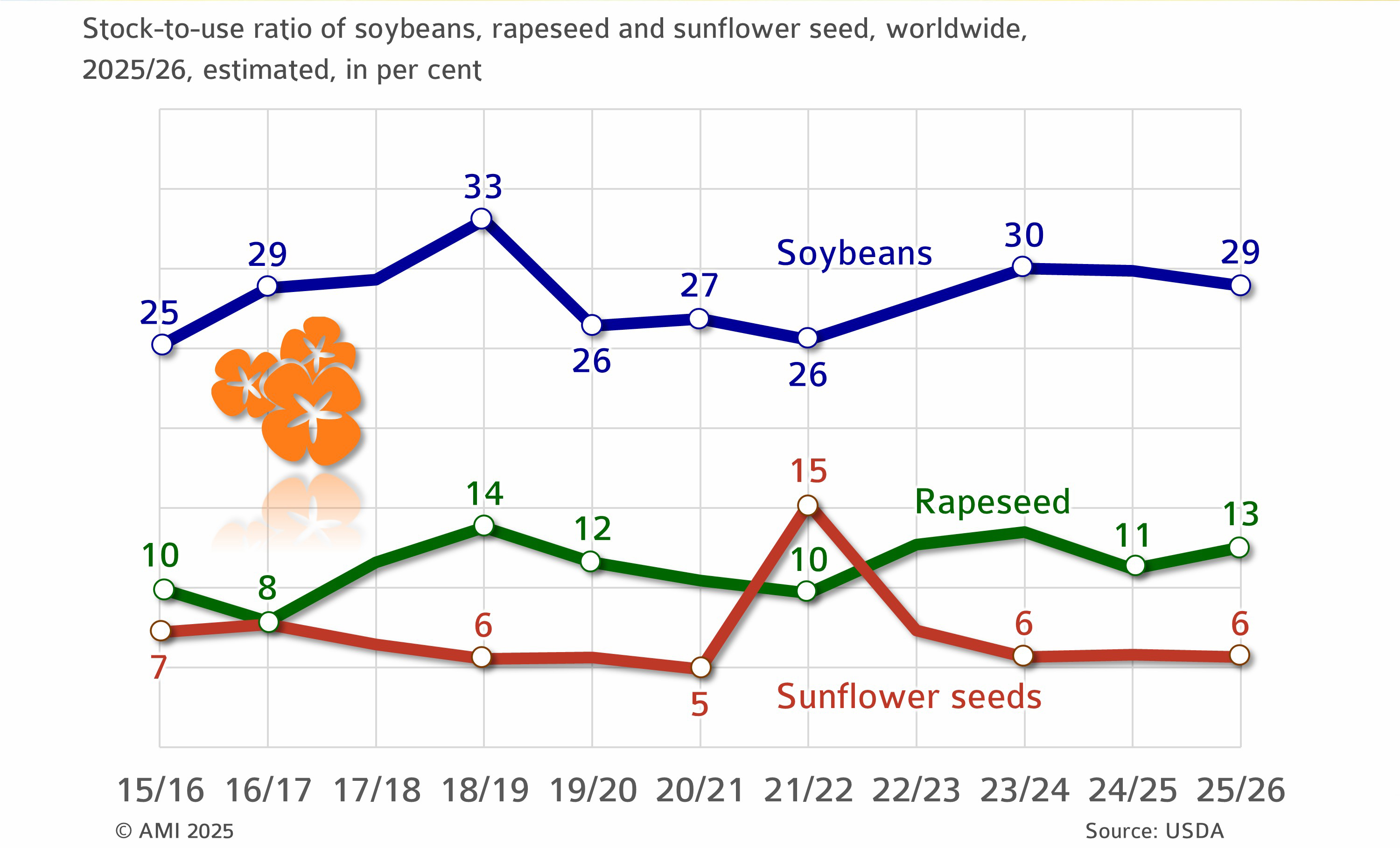

The ratio of supplies to consumption (the “stock-to-use ratio”) is a key indicator in the assessment of the global supply situation and potential price developments. Low values indicate a fast market uptake of supplies and tend to support higher prices.

Despite high production, soybean supplies are expected to shrink slightly in the 2025/26 crop year due to increasing consumption. In particular, China's growing demand for soy protein will cause the stock-to-use ratio to drop to an estimated 29 per cent.

Production and consumption of sunflower seed are both expected to rise. Consequently, global end-of-season stocks will likely remain stable at 6 per cent.

The supply of rapeseed will be significantly more abundant in 2025/26. Following an increase in global production, the stock-to-use ratio will presumably reach 13 per cent, clearly up on the previous year's level.

Supply and demand estimate based on the stock-to-use-ratio

1.2.3.1 Global vegetable oil supply

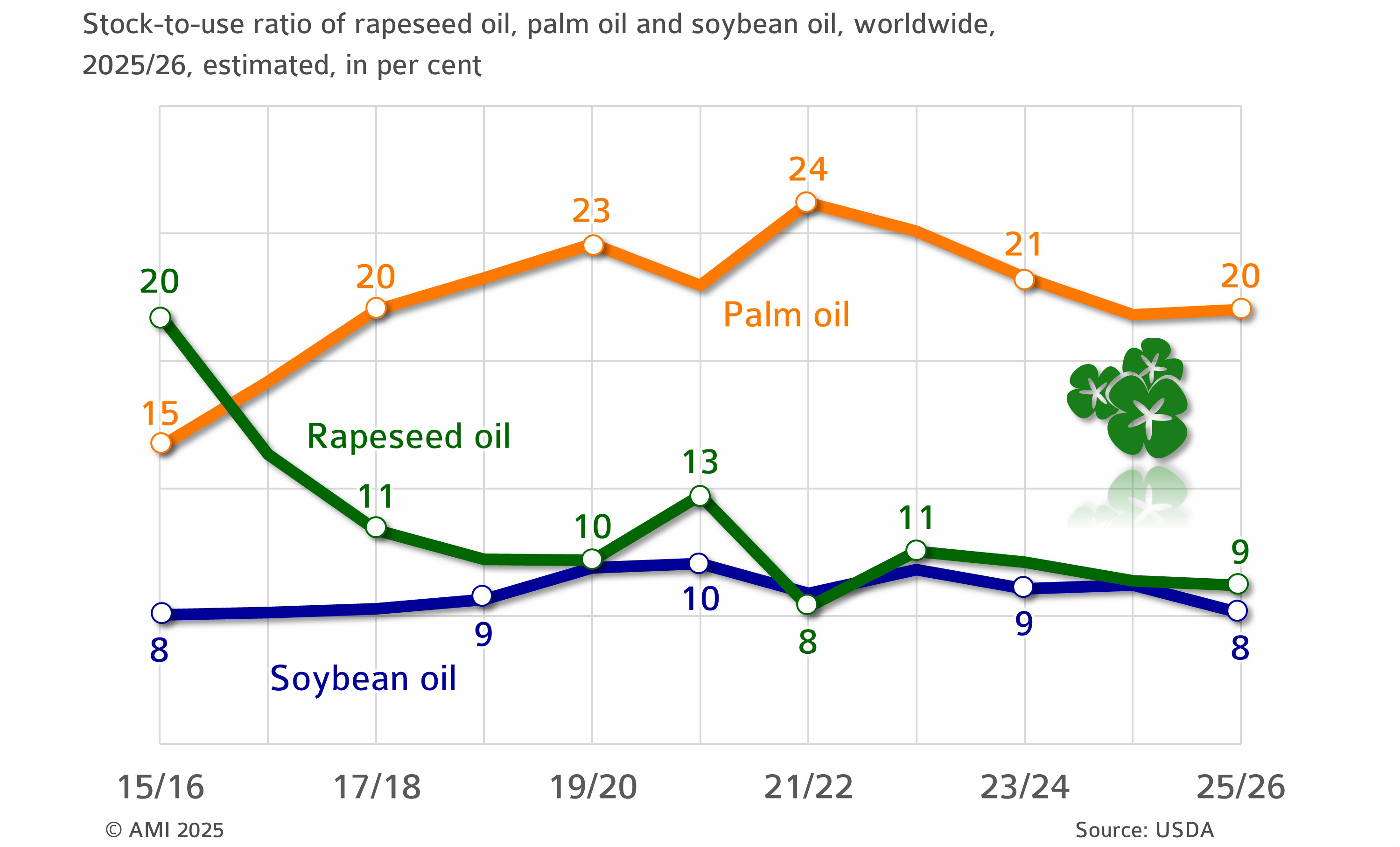

The stock-to-use ratio for palm oil is projected to increase for the first time in three years. It is expected to rise 1.0 per cent compared with the previous year. The picture is different for soybean oil and rapeseed oil. In the case of rapeseed oil, the ratio is anticipated to fall 2.1 per cent, whereas the ratio for soybean oil is expected to be 12.0 per cent below the previous year's figure.

Soybean oil supply declines

Headerbild: jorisvo – stock.adobe.com