6.1.1 War negatively impacts processing but expedites exports

The situation in respect of Ukrainian agriculture remains tense as a result of the war with Russia. High equipment costs, limited availability of diesel and fertilisers, and a shortage of labour are making production considerably more difficult. At the same time, producer prices for grains and oilseeds have fallen, reducing the profitability of many crops. Exporting via the Black Sea corridor remains risky, while high transport costs reduce the economic viability of alternative land routes. Many small and medium sized farms have already ceased operations. Some lands lie fallow or are only gradually being brought back into production.

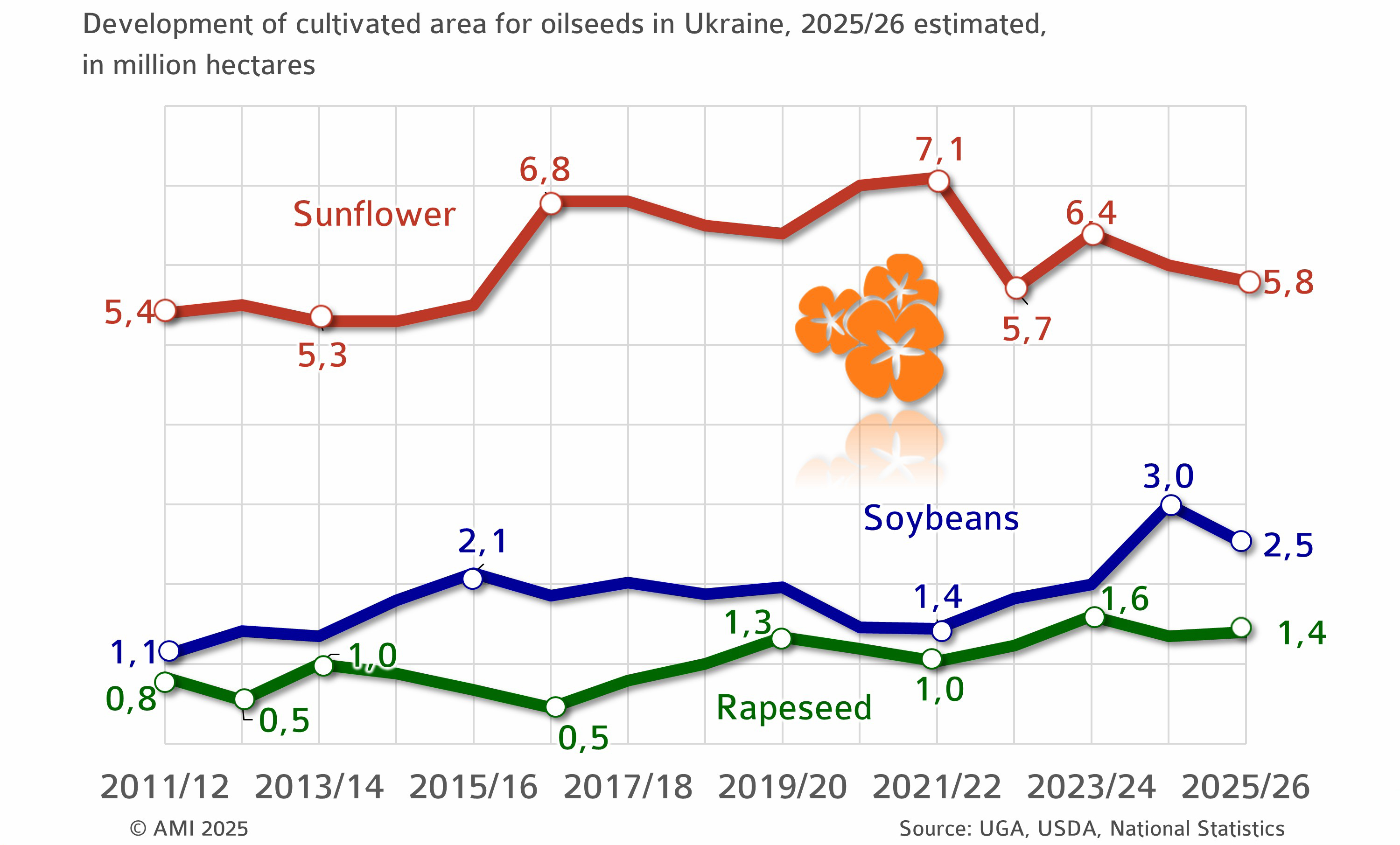

The area under rapeseed cultivation is expected to remain largely stable despite the difficult overall conditions. Rapeseed remains a reliable crop for many farms, partly because processing capacities in Ukraine have been expanded. As a consequence, exports of rapeseed oil and rapeseed meal are expected to increase. In contrast, the trend in sunflower cultivation is clearly downward. Rising production costs, uncertain marketing prospects, and weak price developments are impeding cultivation planning. The decline in soybean area is even more pronounced. Many farmers have switched to other crops due to low profitability in the previous year and the fact that marketing prospects remain poor. This trend is exacerbated by proposed export duties on soybeans.

Less sunflower and soybeans

6.1.2 Processing in Ukraine is recovering slowly

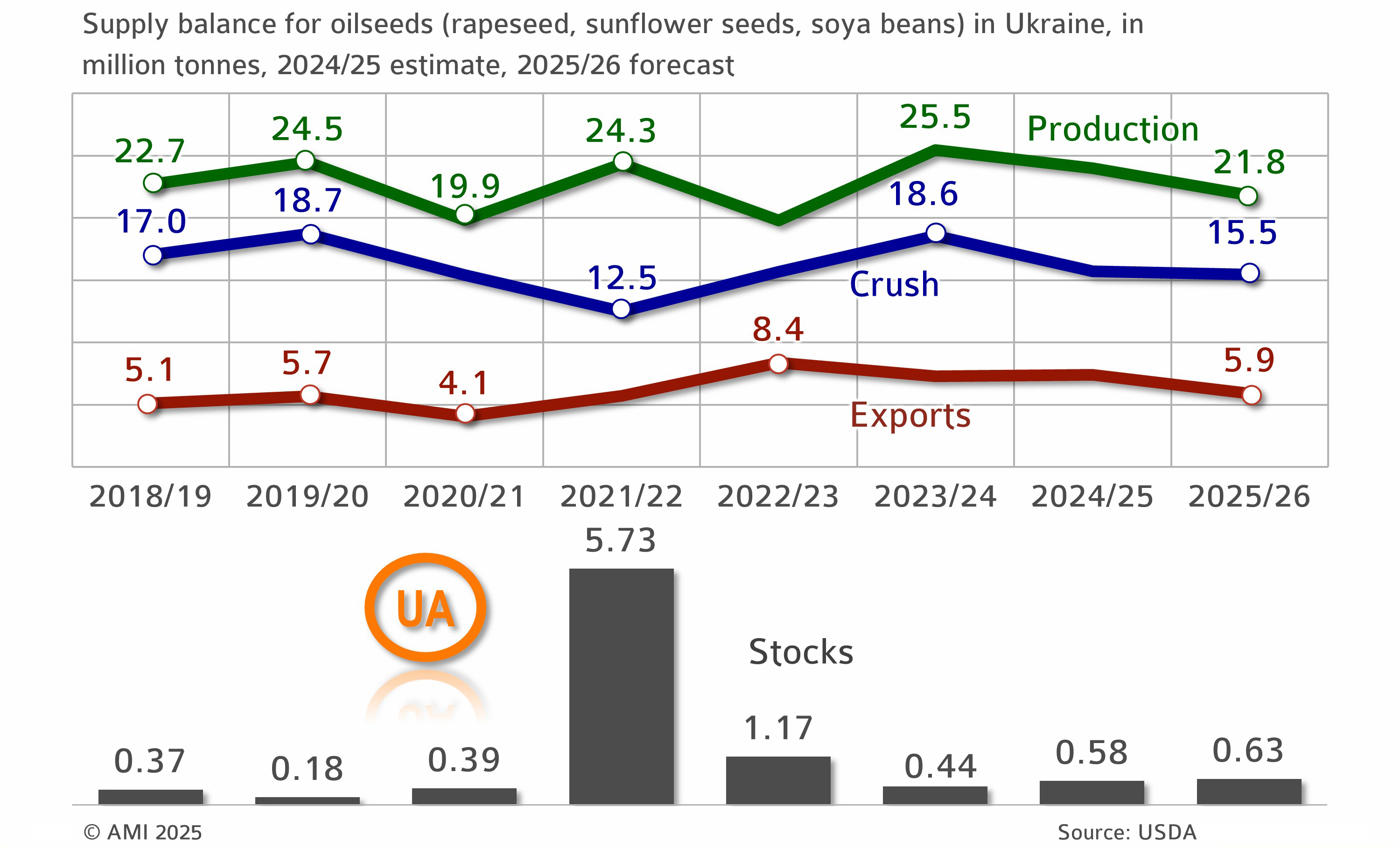

Russia's attack continues to have a significant influence on Ukraine's oilseed sector. Although the situation has stabilised following the sharp downturn in processing in 2022, capacity utilisation remains inadequate to date. High transport and energy costs, damaged infrastructure, and recurring logistical disruptions are steadily slowing down processing. Above all, the processing of sunflower seed remains below pre-war levels.

Nevertheless, Ukraine remains a major supplier on the global market. Exports of raw material increased sharply immediately after the war began due to the industry's temporary inability to process oilseeds. This substantial outflow reduced the stocks that had accumulated.

The relationship between production, processing and exports has now returned to normal. Export volumes have almost recovered to their long-term levels, while processing is growing moderately but still remains below its technical potential. Stocks have stabilised following the dislocations of previous years. Ukraine is generally focusing on domestic processing while continuing to be a key supplier of oilseeds and vegetable oils to the EU.

Smaller harvests, focus on processing

6.1.3 High relevance of rapeseed and sunflower oil

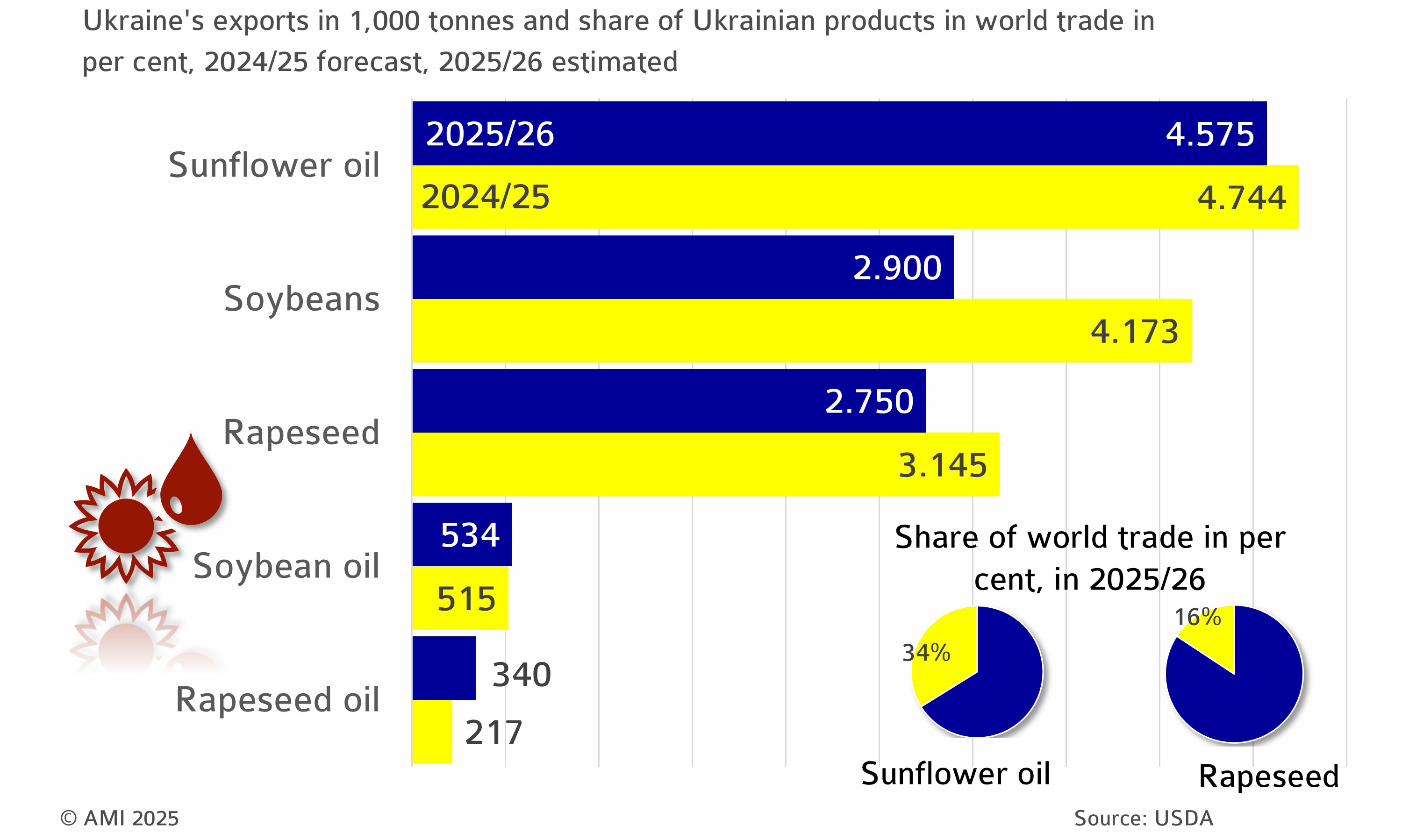

Despite the ongoing war, Ukraine remains a key supplier in international trade in oilseeds and vegetable oils. Ukrainian sunflower oil, in particular, retains its significance for global trade. The share of Ukrainian supply remains high, despite a reduction in exports compared with the previous year. A smaller feedstock base means that the industry is increasingly focusing on domestic processing. This is reflected in rising exports of vegetable oils relative to exports of raw seed.

Ukraine also remains an important supplier of rapeseed to the EU, alongside Australia. By contrast, exports of soybeans are expected to decline. Nevertheless, demand from European feed and food producers for Ukrainian GM-free (non-GM) soybeans remains high. Ukraine retains strategic importance as a supplier, as it is able to provide non-GM commodity in relevant volumes.

Major exporter of oilseeds and products