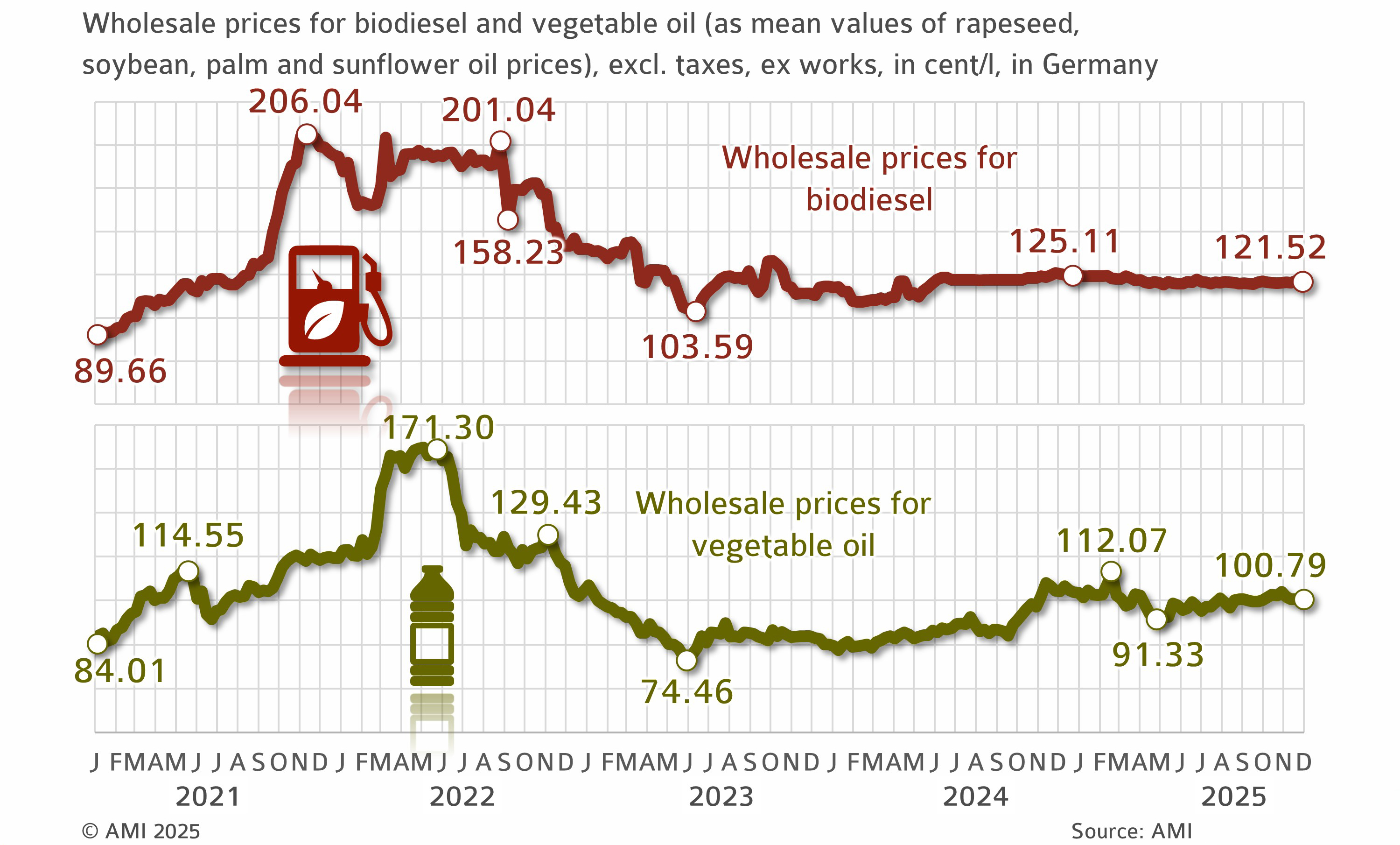

5.1.1 Comparison of prices of bread, bioethanol and wheat

Wheat is used to produce both food and bioethanol. It has been repeatedly claimed that biofuel production causes a shortage in grain supply for food purposes, which in turn leads to higher prices. The development of prices for wheat and rye bread disproves this belief. Bread prices follow their own specific market mechanisms and are influenced by other price-driving factors such as wage levels, energy costs, etc. Farmers feel under pressure to adjust production volumes because producer prices for wheat are sometimes below production costs. There is therefore a need for additional marketing alternatives to support prices and secure farmers' incomes.

Global grain production is heading for a new record in 2025/26, and the supply situation is comfortable. Nevertheless, demand is only growing slowly despite the trend in the biofuels market.

Bioethanol prices have recently picked up somewhat while clearly remaining below the highs recorded at the end of 2021. In summary, it is clear that pricing on the bread market is strongly determined by the costs of processing, energy, wages, and logistics, whereas commodity prices – and therefore also bioethanol production – have little impact.

Price comparison of bread, bioethanol and grain

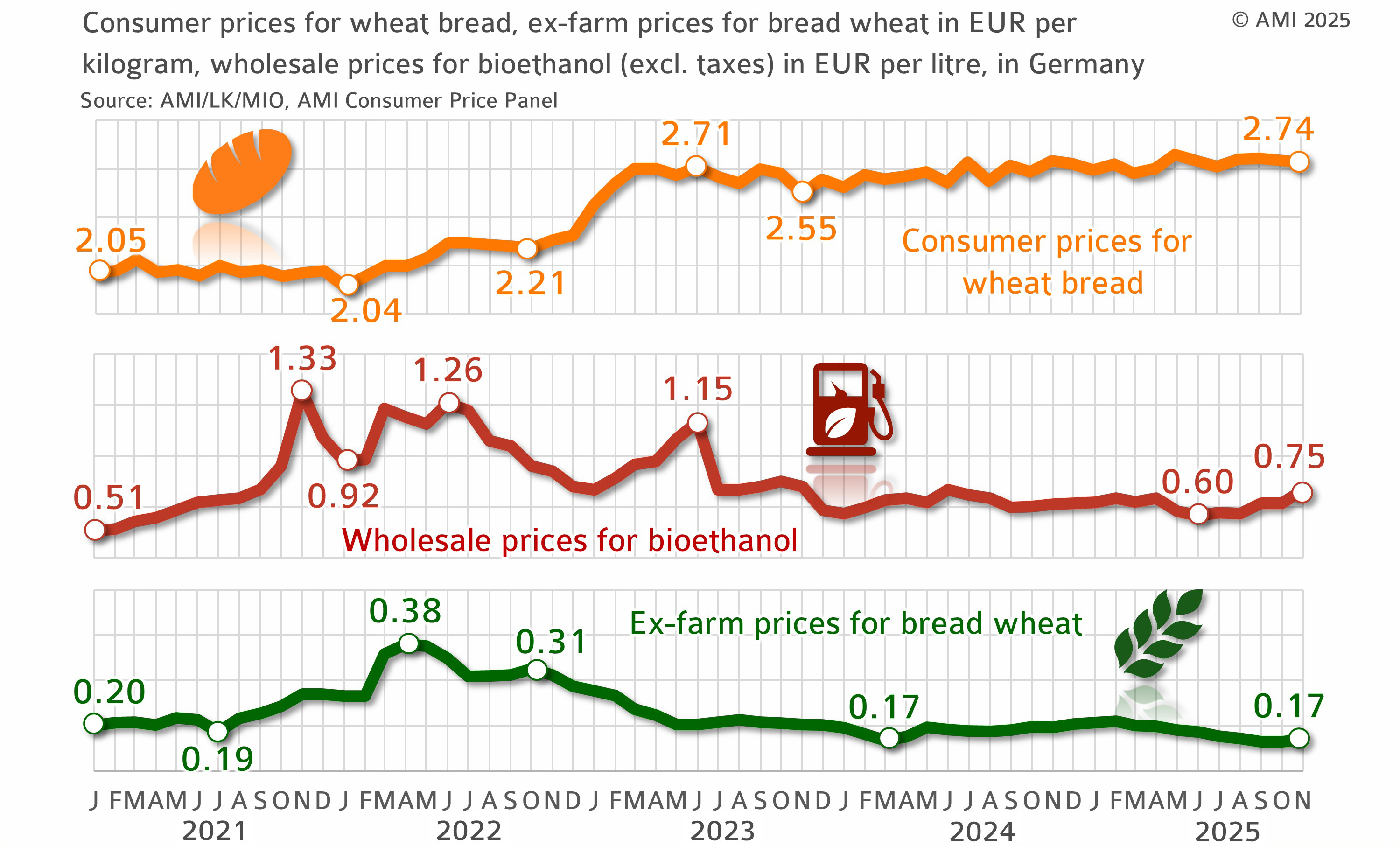

5.1.2 Comparison of prices of biodiesel and vegetable oil

The biodiesel market has been under pressure since 2023. The plunge in prices continued in 2024. These factors have a negative impact on the entire commodity chain. They are due to fraud with UER certificates (crediting of GHG reduction volumes in petroleum production) and extensive imports of allegedly advanced biofuels from China. The EU Commission imposed import duties ranging between 10 and 35.6 per cent (depending on company) to protect the European biodiesel industry. However, the hope of relief in the commodity market due to declining biodiesel imports did not materialise. No customs duties are levied on imports of feedstock (waste oils) from China.

At the same time, GHG quota prices temporarily plummeted to a level below EUR 100 per tonne of CO2 as a consequence of the fraud. The cases of fraud generated surplus GHG reduction quotas that were, and continue to be, traded legally (to protect trust). Taken together, these factors caused physical sales of biodiesel and HVO to dwindle sharply.

From a consumer's point of view, this pressure on the market and the supply of less expensive edible rapeseed oil may have seemed to be an advantage. However, it should be noted that if prices fail to cover costs, farmers might change the crops they grow within their rotation systems and leave out rapeseed. This would ultimately lead to a decline in the range of products on the supermarket shelves. As such, this is a fundamental dilemma agriculture is faced with.

Price comparison of vegetable oil und biodiesel