2.5.1 Origins of feedstocks for biodiesel and HVO used in Germany

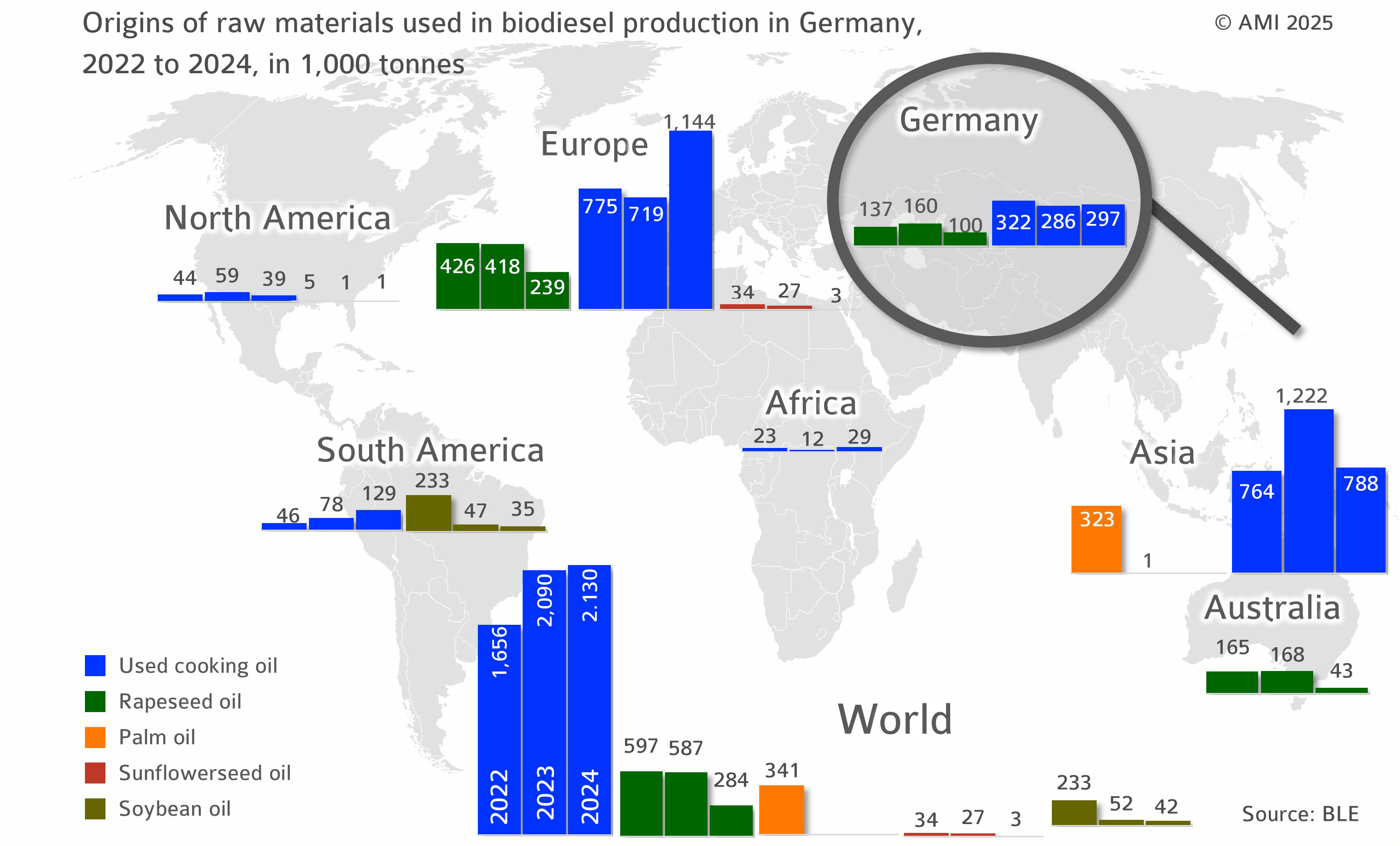

About 2.1 million tonnes of biofuels that were credited towards GHG reduction obligations in the diesel market were marketed in 2024. The majority was based on waste oils and fats. When looking at biodiesel from rapeseed oil, it should be noted that the processing of rapeseed yields not only rapeseed oil but also rapeseed meal, a protein-rich animal feed. Nearly 59 per cent of the feedstock used for biofuel production – rapeseed oil and waste oils – was sourced in Europe in 2024. The total amount of rapeseed oil used in Germany in 2024 was 284,000 tonnes, of which 43,000 tonnes came from Australia, and approximately 239,000 tonnes originated from European rapeseed. Rapeseed oil from Canada has only played a secondary role so far.

Biofuels derived from palm oil can no longer be credited towards quota obligations since 2023. The feedstock no longer plays a role in Germany and other member states (such as Italy, France, and Austria). The decrease is offset by the pronounced increase in biofuels derived from waste oils and fats in 2024, amounting to 1.744 million tonnes. The share of soybean oil-based biodiesel declined further, from 52,000 tonnes to 42,000 tonnes. By comparison, this figure was 232,000 tonnes in 2023.

In Germany, high-quality information on biomass, waste and residues used in biofuel production is systematically recorded and stored in a database called Nabisy and published annually in a report by the Federal Office for Agriculture and Food (BLE). The exemplary traceability system records the volumes marketed as transport fuels and heating fuels (CHP plants). The European Commission needs to guarantee that annual reports are of equally high quality once the Union Data Base (UDB) works reliably across all economic sectors included in its remit.

Imports from Europe dominate