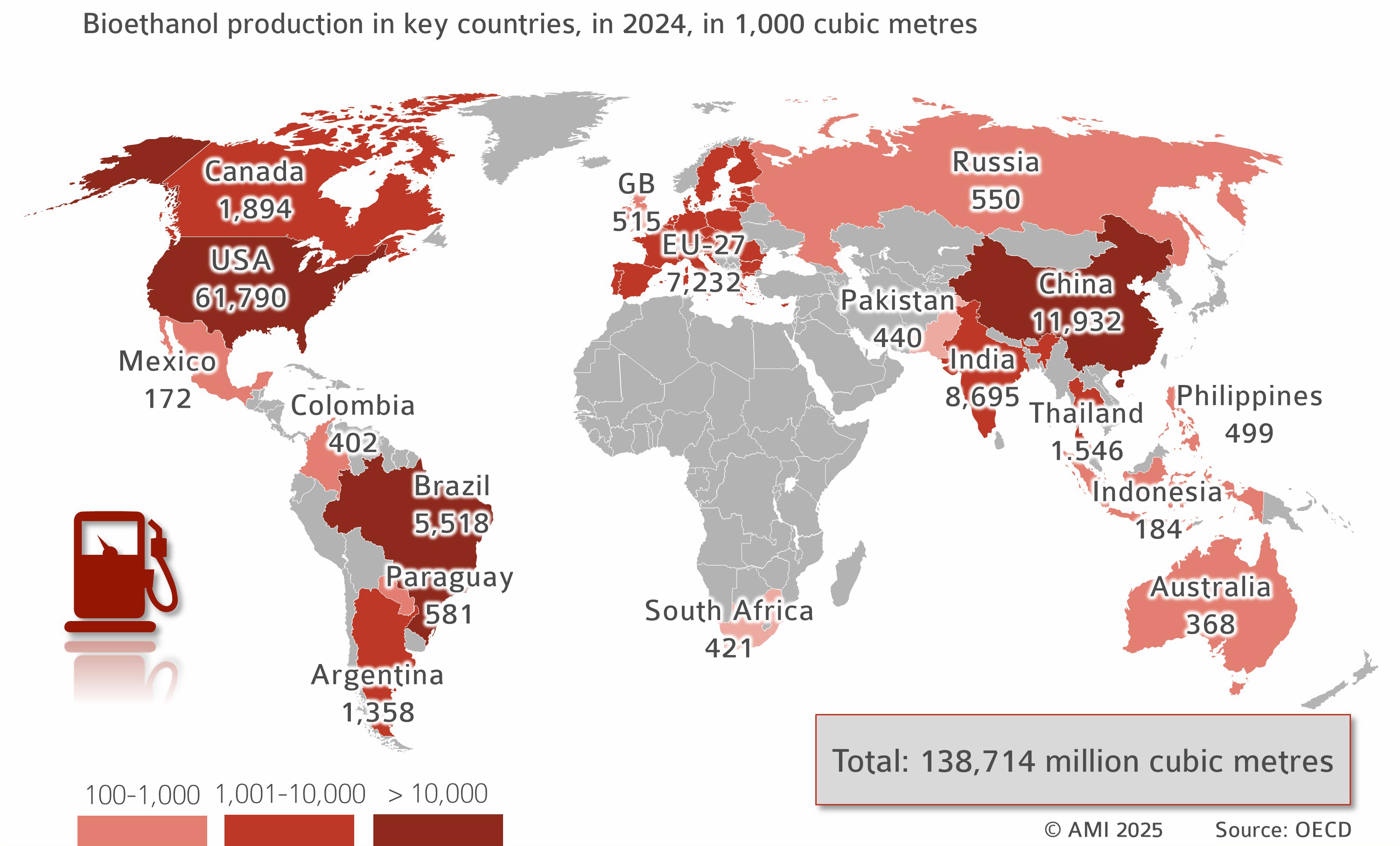

2.1.1 Global output of bioethanol

Worldwide, a new record high of 138,714 million cubic metres of bioethanol was produced in 2024. Bioethanol helps reduce the use of fossil energy sources, makes a contribution to climate protection and power supply security, and helps maintain agricultural feedstock prices. Blending quotas (relating to energy, volume or greenhouse gas reduction) have become globally accepted as a flexible instrument to achieve this aim. Policy therefore has a direct influence on the scale of bioethanol production and trade in biofuels.

In the EU, crediting of biofuels from cultivated biomass is limited to 7 per cent of final energy consumption in road traffic. Member states usually set lower caps. As a consequence of increasing electrification, physical demand for fossil fuels is in decline and, as a result, so is demand for biofuels. This is why a “food or fuel” debate in European biofuels politics is redundant, especially because feedstocks for biofuel production can be used to supply the food markets at any time.

Global consumption of grain to produce bioethanol will likely pick up in 2025/26. The use of grain (especially maize) is expected to increase 1.8 per cent, reaching 203.2 million tonnes. According to information from the International Grains Council (IGC), cereal production (including rice) will rise 4.5 per cent to 2.4 billion tonnes at the same time.

The US remains the largest producer of bioethanol with output reaching 61.8 million cubic metres (+1.4 per cent year-on-year), primarily made from maize. Brazil follows with 35.5 million cubic metres, mainly based on sugar cane. In the EU-27, bioethanol production amounted to around 7.2 million cubic metres, mainly based on maize, wheat and sugar beet.

Bioethanol production continues to grow

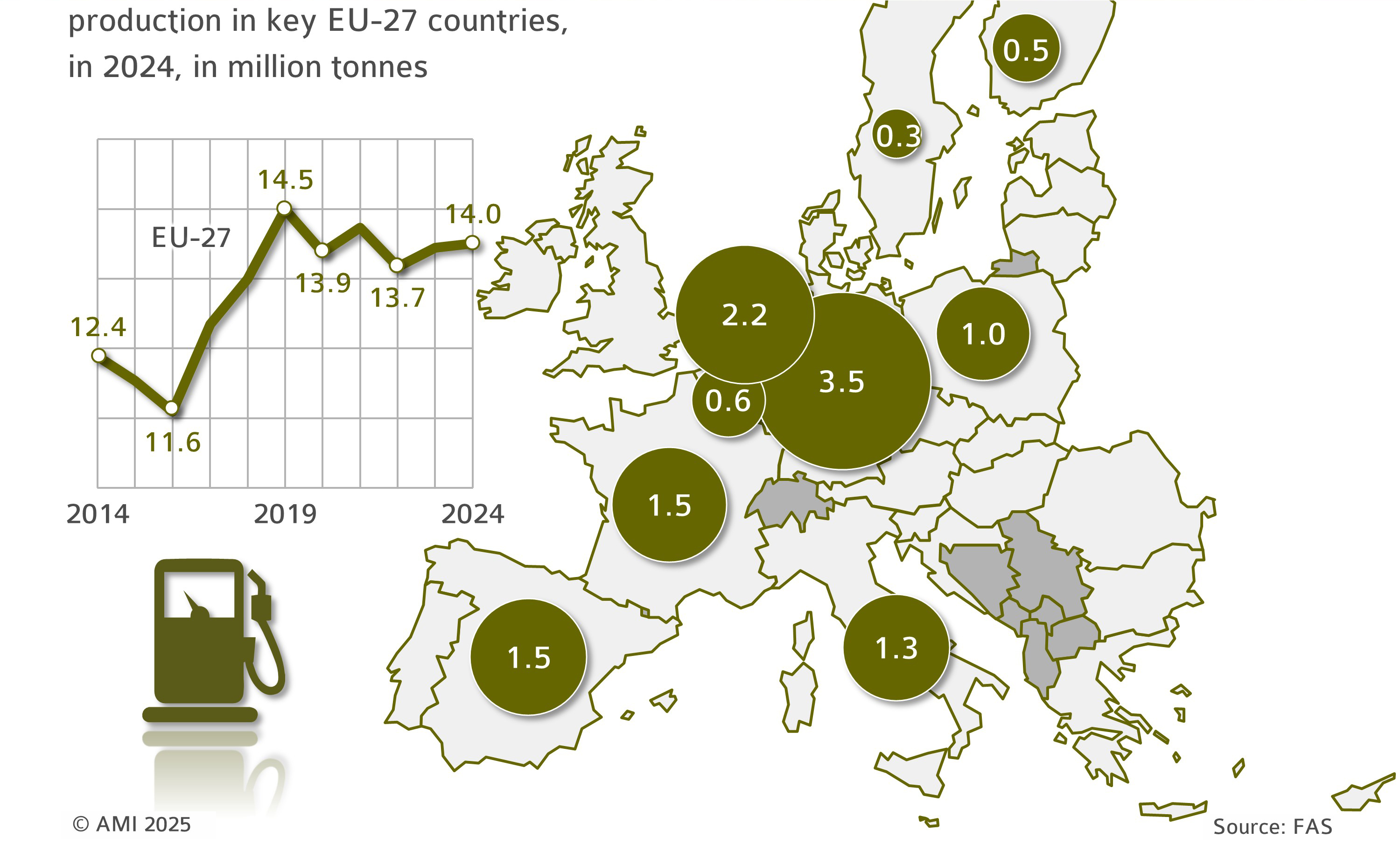

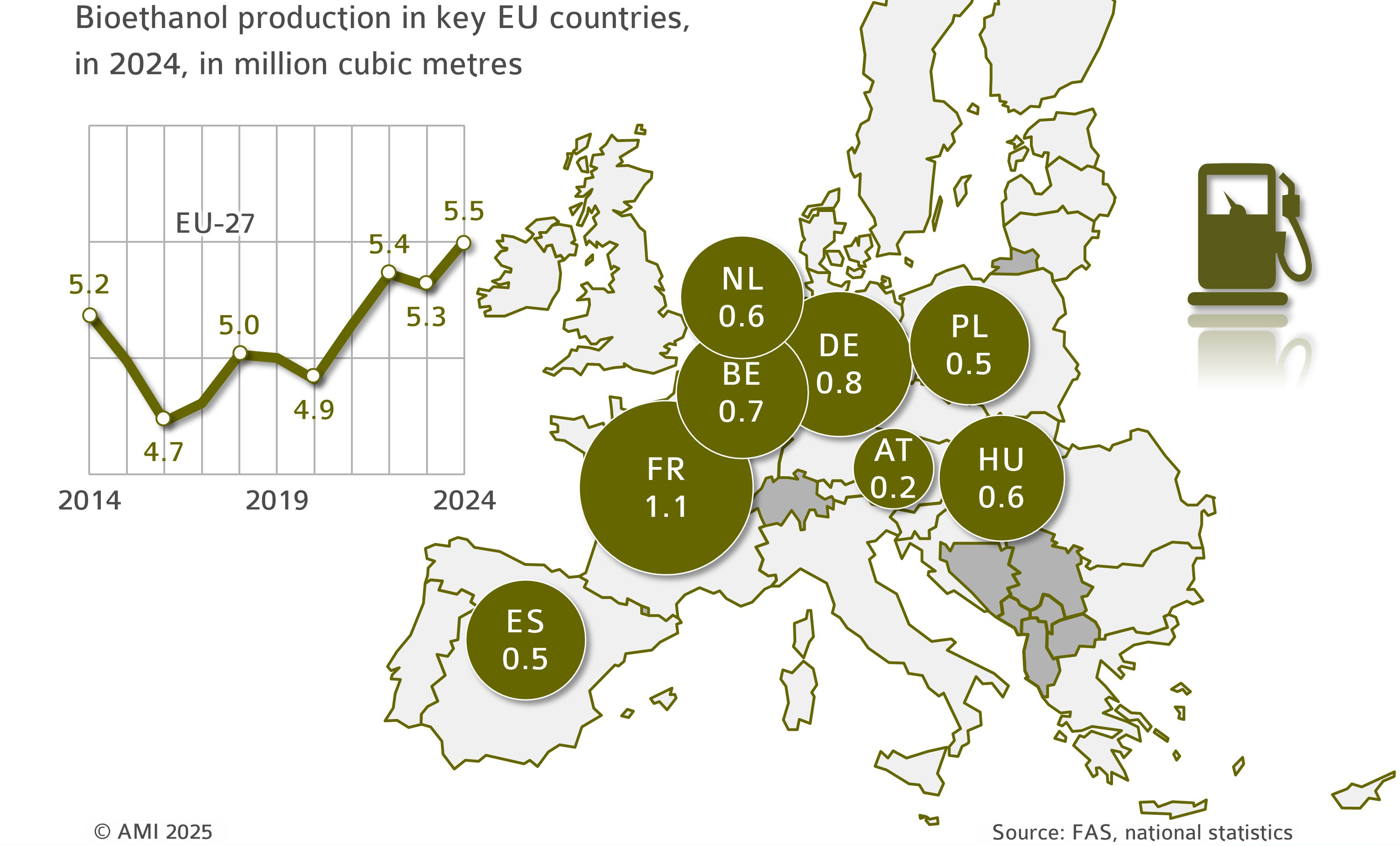

2.1.1.1 Key EU-27 bioethanol producers

Production of bioethanol in the EU-27 rises

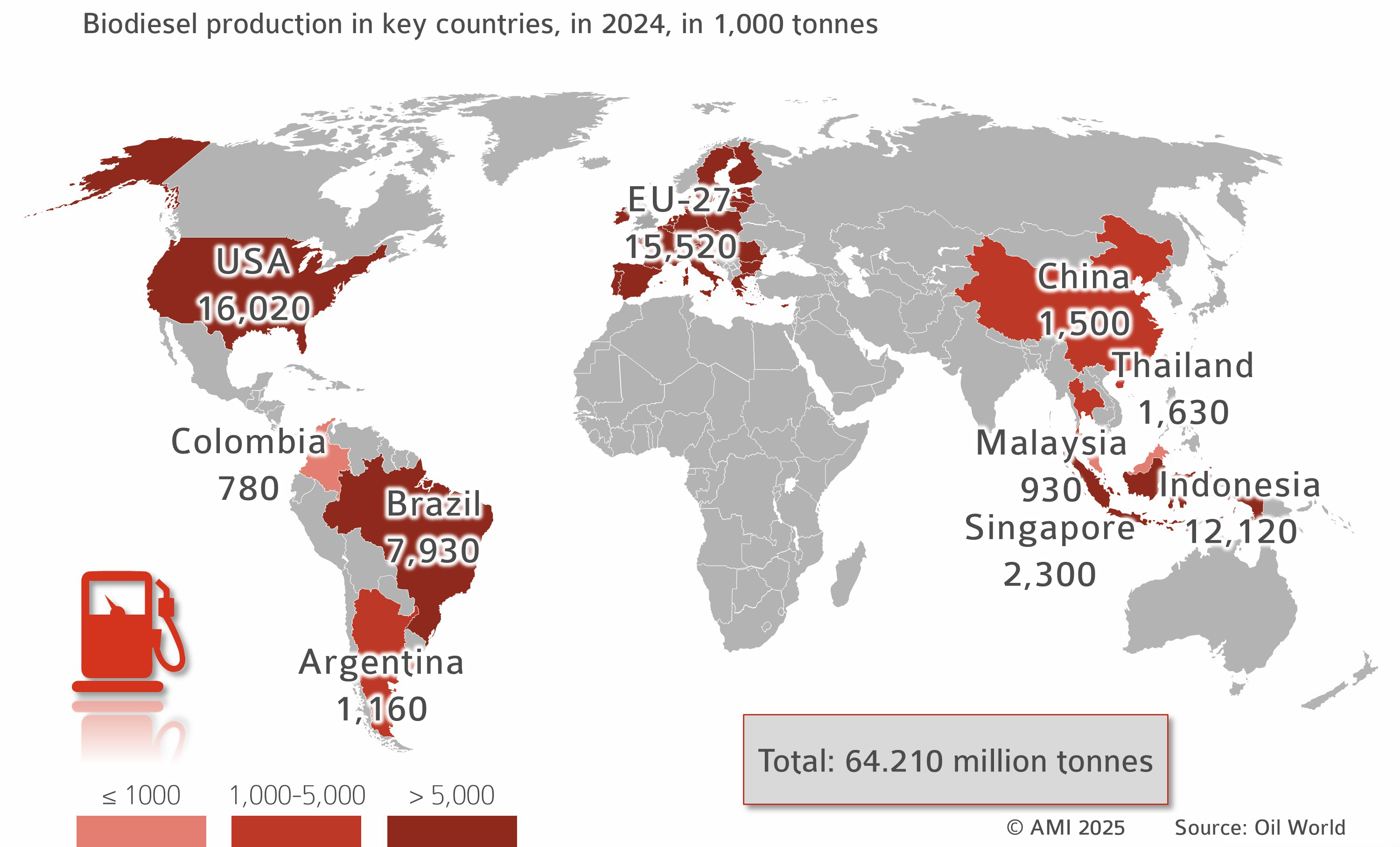

2.1.2 Global output of biodiesel (incl. HVO)

The US was the biggest producer of biodiesel and hydrotreated vegetable oil (HVO) for the first time in 2024, ahead of the EU-27. The US accounts for 16.02 million tonnes, representing around one fourth of global production. The EU-27 follows with 15.52 million tonnes and a share of 24 per cent. Biodiesel production is concentrated in the US, the EU-27, Indonesia and Brazil. In Europe, biofuels are mostly made from rapeseed oil, whereas in North and South America it is mostly based on soybean oil. As a consequence of the gradual rise in biodiesel use for blending (from B20, B30 and B40 to B50 from 2026 onwards), Indonesian biodiesel production hit another record high at 12.12 million tonnes. By expanding palm oil production further, the government pursues the aim of gradually reducing the country's reliance on crude oil and diesel fuel imports. By contrast, Malaysia reduced its biodiesel production in 2024 by around 28 per cent to 0.93 million tonnes.

USA expands biodiesel production

2.1.2.1 Key EU-27 biodiesel producers

Germany remains the largest biodiesel producer in the EU