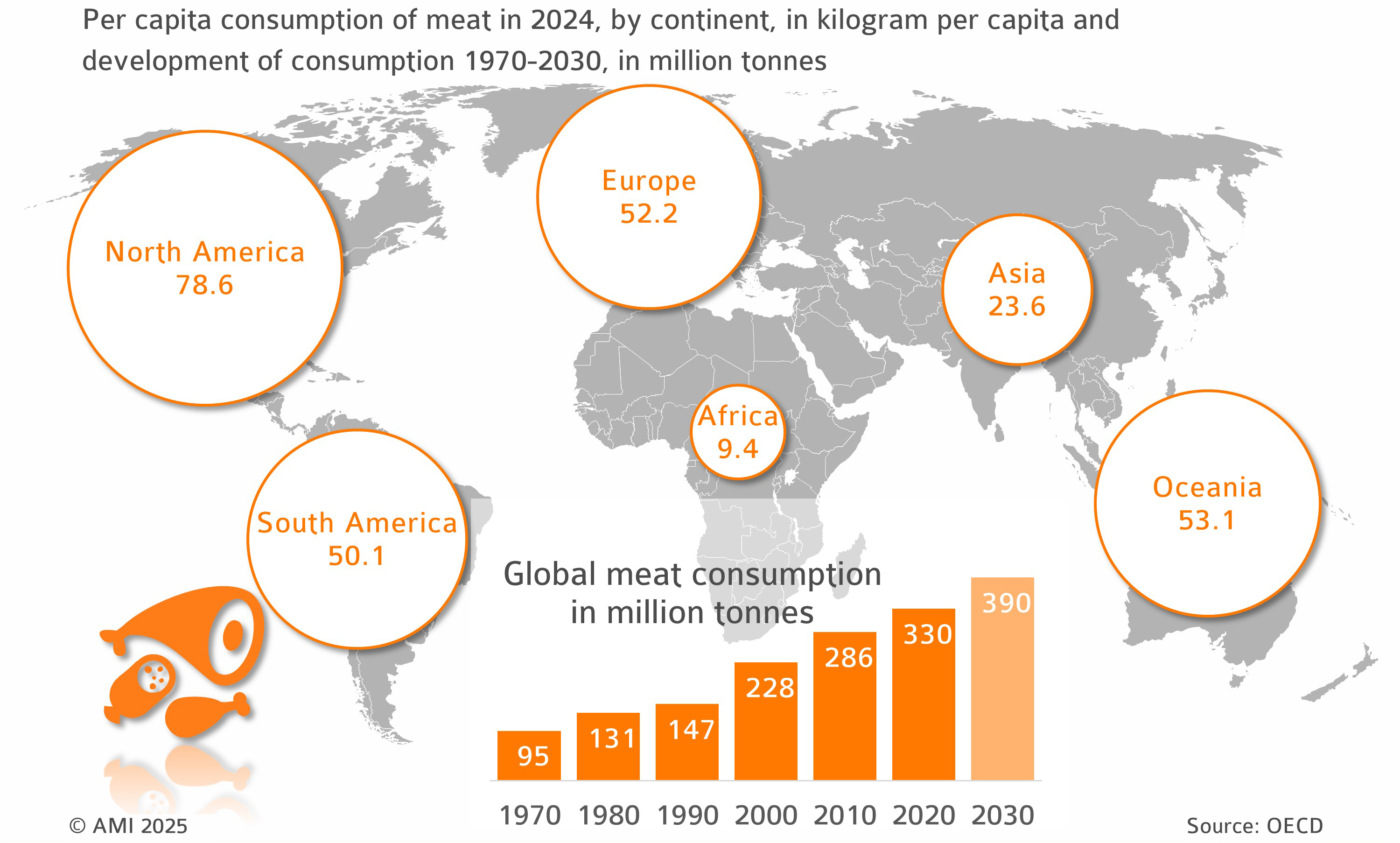

3.2.1 Global consumption of meat by continent

World meat consumption has increased significantly over the past decades and is set to increase further. The growth is not just due to the rise in the world's population, but also to higher household incomes in Asia (China) and the associated changes in eating habits. Low consumer prices, especially for pork, are further increasing demand.

With growing meat consumption, demand for feedstuff also rises. Soybeans and rapeseed are the primary protein sources used in animal feed, along with grains. It should be noted that soy and rapeseed differ significantly in terms of meal content (80 per cent and 58 per cent, respectively) and protein quality. On a global scale, most soybean meal is produced from genetically modified (GM) soybeans. By contrast, the European Union exclusively grows GM-free oilseeds such as rapeseed, sunflowers, and soybeans. Demand for dairy products that carry the “without GM” declaration label strengthens the ties to regional and European oilseed production. This aspect of the “binding” of land is gaining importance because, as part of the “Farm to Fork” strategy, EU climate-change legislation is increasingly geared towards sustainability and reduction of greenhouse gas emissions.

Meat consumption grow until 2030

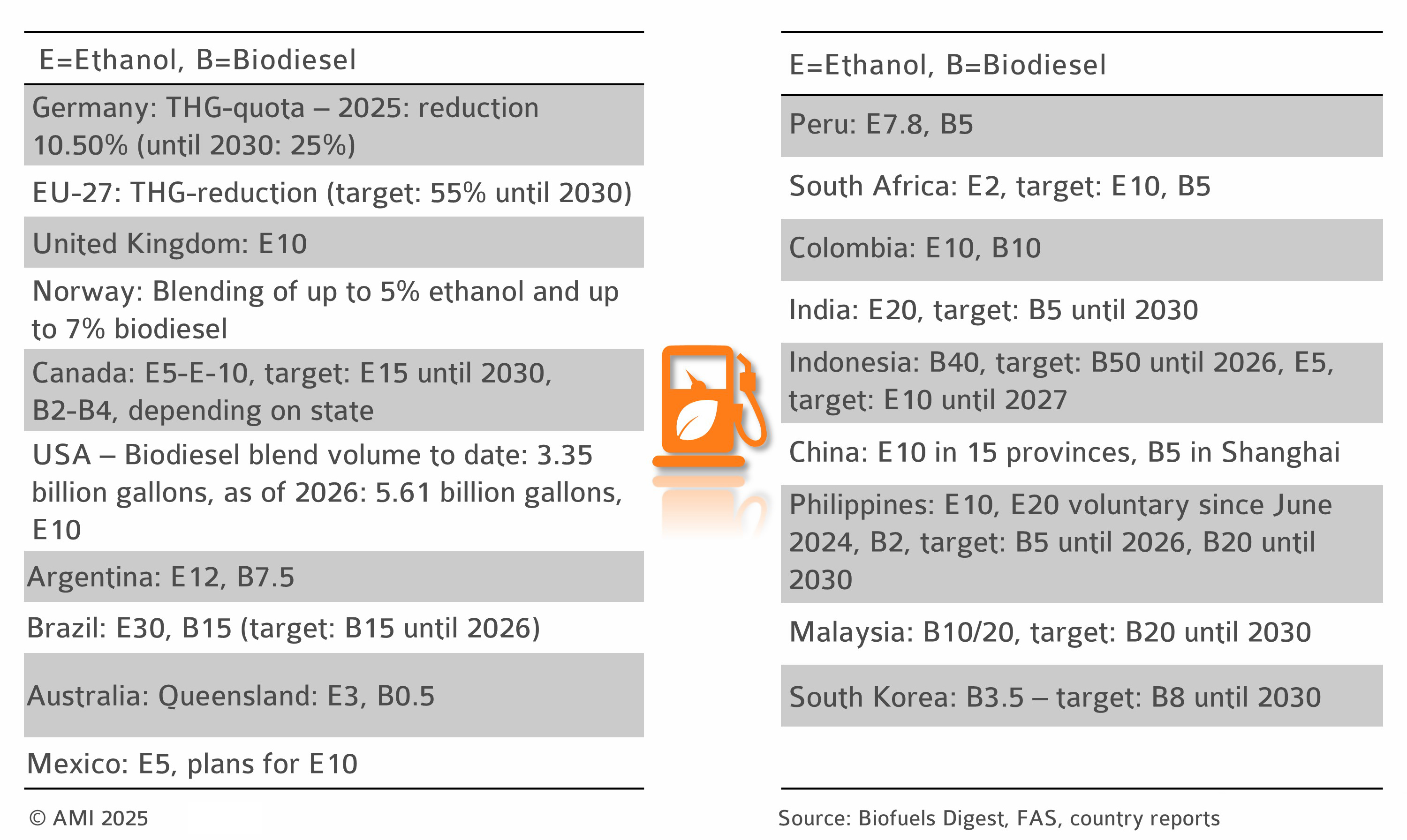

3.2.2 Blending quotas for biodiesel

All across the world, biofuels are primarily supported through legal blending mandates and greenhouse gas (GHG) reduction obligations. The goals in the transport sector differ depending on the region: In the US, the main focus is on contributing to security of supply and improving farmers' incomes, with different political strategies across the different states. Brazil additionally pursues climate mitigation targets. In the EU, the focus in on climate protection, while support for e-mobility and the expansion of renewable energy also play a key role. In Germany in particular, the switch to electric drive systems is extensively promoted, for example through tax breaks, financial subsidies for vehicle purchases, and the expansion of photovoltaics. Biofuels, on the other hand, are taxed at the full rate applicable to the respective fossil fuel substitute (biodiesel/HVO: 47.07 cents/l and bioethanol 65.45 cents/l) and therefore do not place a burden on the federal budget.

In several Asian countries, such as Indonesia and Malaysia, and also in Argentina, the quota policy aims to reduce temporary surpluses of vegetable oil or feedstock in an effort to stabilise prices. Such motives are reflected in high quota mandates for biodiesel (e.g. Indonesia B40, target B50) and rising quota mandates for ethanol (e.g. India to E20). Among biofuels from cultivated biomass, ethanol is internationally by far more important than biodiesel or HVO.

In Germany, the greenhouse gas reduction quota (GHG quota) has been in force since 2015. A 10.5 per cent reduction target has been set for 2025, which will rise to 25 per cent by the end of 2030. The legal basis is currently under revision in order to transpose the revised Renewable Energy Directive (2023/2413 – RED III) into national legislation. The law, which is expected to come into force in 2026, provides for a gradual increase of the GHG reduction quota to a minimum of 53 per cent in 2040. With these specifications to reduce greenhouse gas emissions, Germany is leading the way internationally.

Blending quotas promote use of biofuels

Headerbild: jorisvo – stock.adobe.com