1.1.1 Global grain production

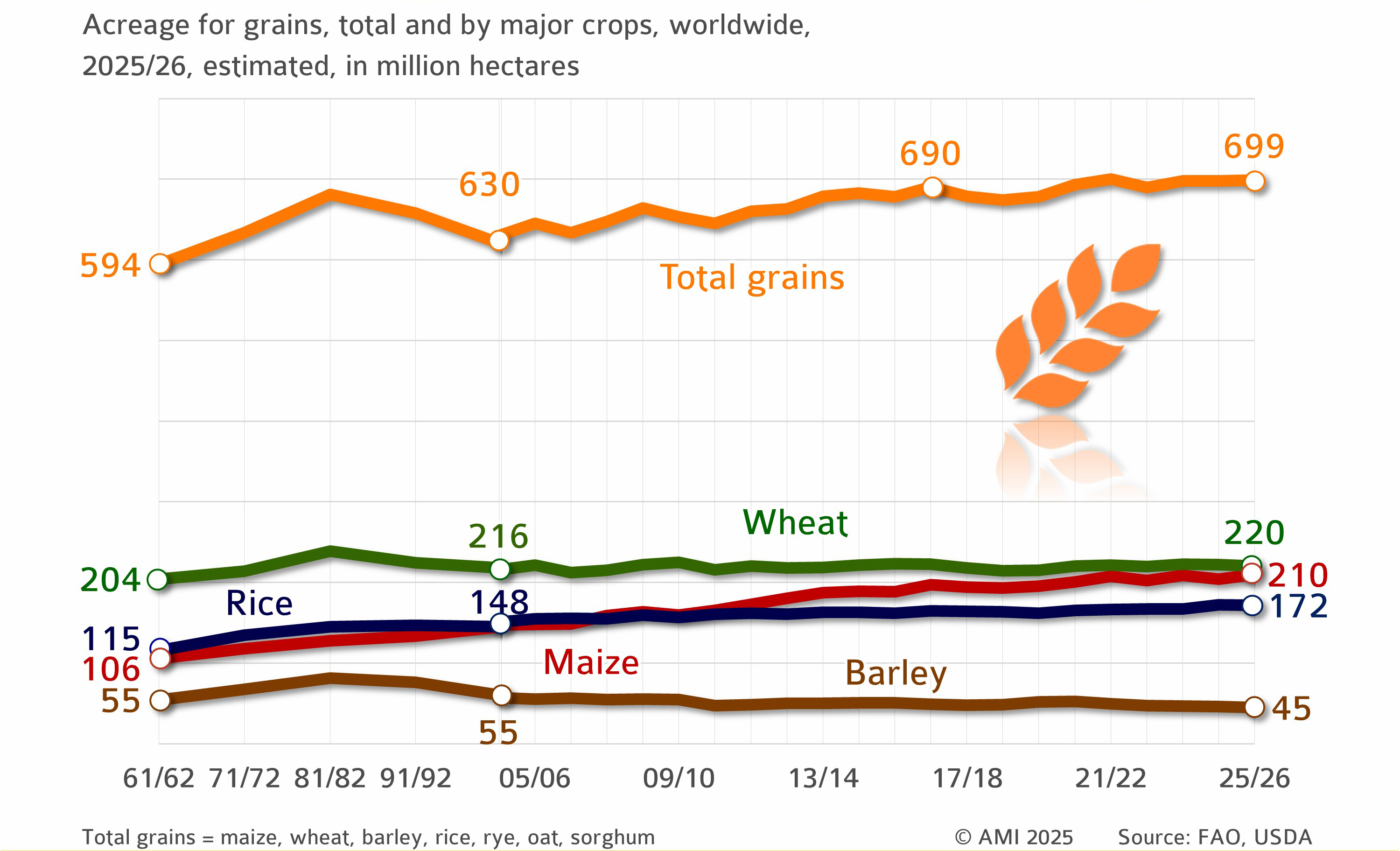

The world area planted with grain increases in 2025/26, falling just short of the record 700 million hectare high reached in 2021/22. About 699 million hectares are forecast for the current season. Maize hectarage is expected to grow 2.8 per cent, reaching 209.9 million hectares. In contrast, the wheat area will likely decrease 1 per cent to 220.2 million hectares. By comparison, the land used for barley cultivation is anticipated to fall by around 2.4 million hectares to 44.8 million hectares. The rice area remains virtually unchanged at 171.7 million hectares.

Global grain production has benefited for several decades from progress in plant breeding and improvements in production methods. More efficient fertiliser application, precision crop protection and low-loss harvesting and storage processes all contribute to boosting yields. Maize production has more than quadrupled since 1972/73. Wheat and rice harvests also more than doubled – notwithstanding periodic dry and heat spells in major producing countries in the northern hemisphere.

Maize remains the world's most important crop for feeds and bioethanol, especially in the US. Barley is predominantly used for feed purposes, while wheat and rice are mainly for human consumption.

Acreage for maize above previous year

1.1.2 Global grain supply

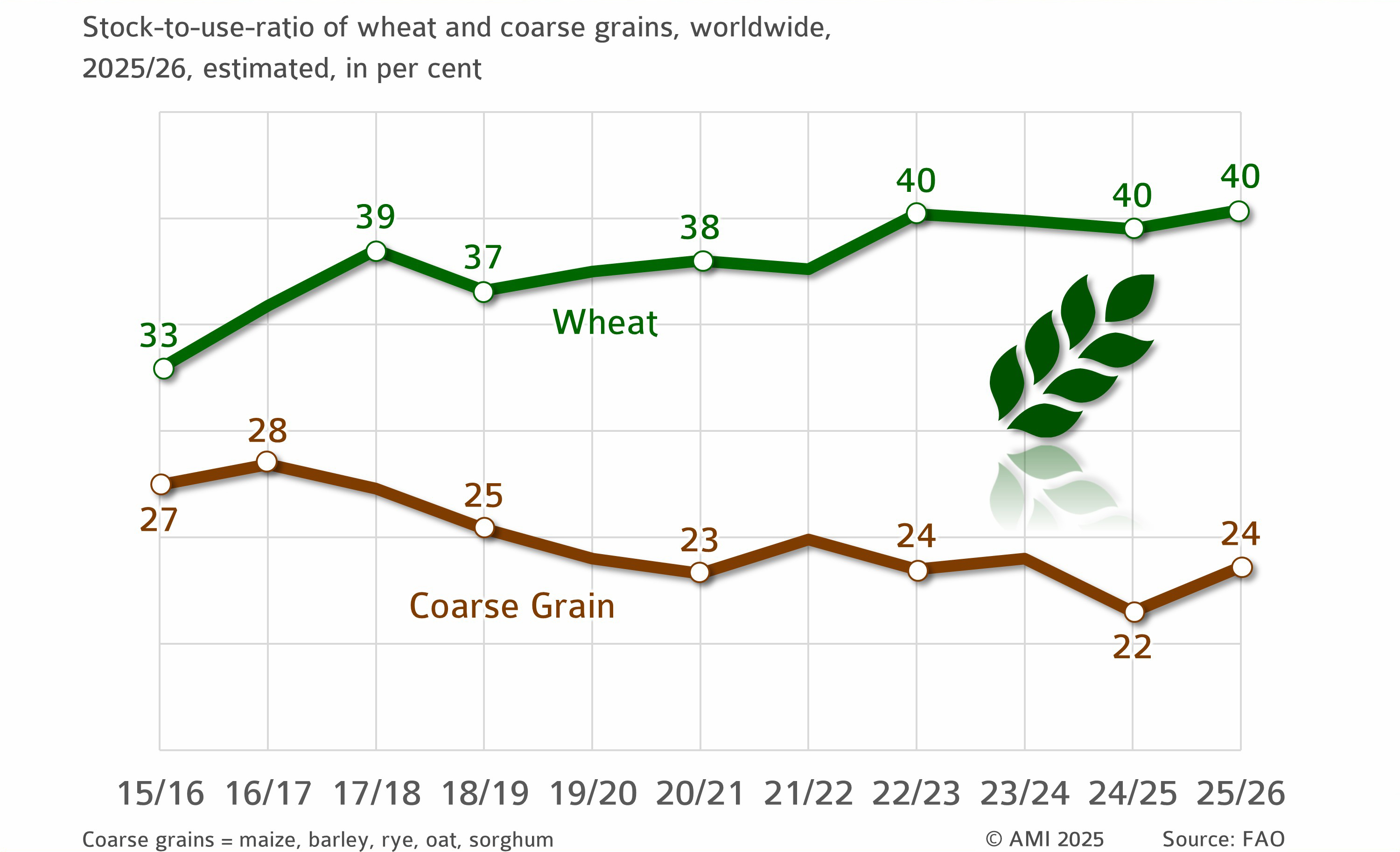

The ratio of supplies to consumption (the “stock-to-use ratio”) is a key coefficient in the assessment of the global supply situation and, consequently, the potential development of prices. Low values indicate fast market uptake of supplies and tend to support higher prices.

Wheat supplies are expected to exceed consumption again in 2025/26. According to preliminary estimates, the stock-to-use ratio will probably rise to 40.4 per cent. In other words, the supply situation is set to remain comfortable. Adequate supply and strong competition among exporters have led to a continued downward trend in international wheat prices over the past few months. In October 2025, prices were down on average 6.3 per cent year on year.

Global output of coarse grains is expected to increase to 1,614 million tonnes in 2025/26. As a result, the stock-to-use ratio rises 23.6 per cent to a level slightly up on the previous year's figure. This means that supply will be marginally more favourable than 2024/25.

Supply and demand estimate based on the stock-to-use-ratio